Smart Money, Digital Tools: How Fintech and Robo-Advisors Are Changing Wealth Management

Opening Perspective: Wealth Management Is No Longer Just for the Wealthy

Not long ago, the phrase “wealth management” evoked images of private bankers, tailored suits, and exclusive offices. The service was often perceived as something reserved for individuals with substantial assets and complex portfolios. For the majority of people, managing money meant little more than saving, basic investing, and occasional financial advice from a bank.

Today, that perception is changing rapidly. Fintech platforms and robo-advisors have redefined what wealth management looks like and who it is for. With a smartphone, an internet connection, and relatively small amounts of capital, individuals can now access tools that automate investing, track long-term goals, and offer structured financial guidance.

This article takes a practical, reader-friendly look at digital wealth management. Rather than focusing on technical models or industry jargon, it explores how fintech and robo-advisors fit into everyday financial decision-making, what they do well, where they fall short, and how individuals can use them effectively.

The Shift from Human-Centered to System-Driven Advice

Traditional wealth management relies heavily on personal relationships. Advisors gather information, interpret client needs, and recommend strategies based on experience and judgment. Digital wealth management approaches the same problem differently.

Instead of conversations, it relies on

• Structured questionnaires

• Algorithms built on financial theory

• Automated execution and monitoring

• Scalable, repeatable processes

This shift does not necessarily imply superiority. Rather, it reflects a trade-off. Human advice offers flexibility and emotional support, while system-driven advice emphasizes consistency, cost efficiency, and accessibility.

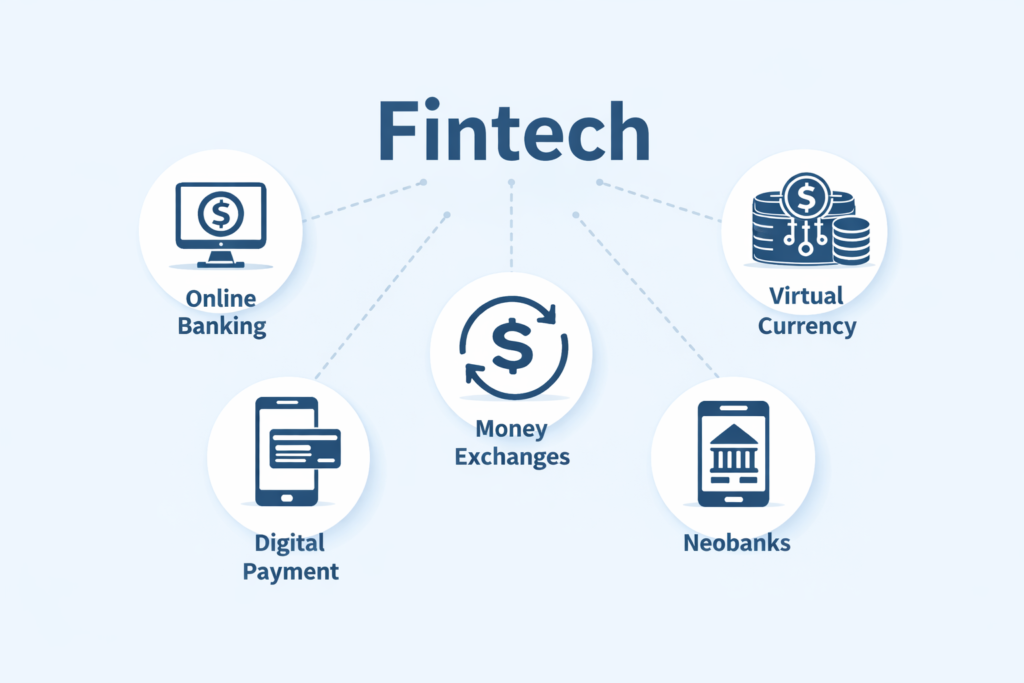

What Digital Wealth Management Really Includes

Digital wealth management is broader than many people assume. Robo-advisors are a key component, but they are not the whole system.

Most platforms combine several elements

• Investment portfolio construction and rebalancing

• Goal-based planning for retirement, education, or major purchases

• Performance monitoring and reporting

• Risk assessment and asset allocation

• Educational tools embedded in the user experience

The result is an integrated environment where users can view their financial situation holistically rather than as isolated accounts.

Robo-Advisors in Practice: How They Actually Work

At a functional level, robo-advisors are designed to simplify investing. Their process generally follows a predictable structure

• The user answers questions about goals, income, time horizon, and risk tolerance

• The platform maps responses to a predefined investment model

• Funds are allocated automatically across diversified assets

• Portfolios are rebalanced periodically to maintain alignment

Most robo-advisors rely on diversified funds rather than individual stocks, reducing complexity and lowering costs. For many users, this removes the pressure of making frequent investment decisions.

Why Fintech Platforms Appeal to Modern Investors

The appeal of digital wealth tools is not accidental. Several behavioral and structural factors support their adoption

• Lower fees compared to traditional advisory services

• Transparency in pricing and portfolio composition

• Ease of use and intuitive design

• Alignment with digital-first lifestyles

For individuals who value clarity and independence, fintech platforms often feel less intimidating than traditional financial institutions.

Where Digital Tools Add the Most Value

Digital wealth management tends to be especially effective in specific scenarios

• Early-stage investing with limited capital

• Long-term, goal-oriented saving

• Investors seeking structure without complexity

• Individuals prone to emotional trading

Automation helps reduce impulsive behavior, encouraging consistent contributions and long-term thinking.

The Limits of Automation and Standardization

Despite their advantages, robo-advisors are not universally suitable. Their design is built around standardization, which can become a limitation.

Common challenges include

• Difficulty accommodating unusual financial situations

• Limited adaptability during life transitions

• Overreliance on historical data

• Minimal emotional support during market downturns

Recognizing these boundaries helps users position digital tools appropriately within their broader financial strategy.

Risk Tolerance: More Nuanced Than a Questionnaire

Risk profiling is central to robo-advisory systems, yet it is often simplified. Questionnaires translate personal preferences into numerical scores, assuming rational and consistent behavior.

In reality, investors may react differently when markets decline sharply. Awareness of this gap allows users to approach recommendations with healthy skepticism rather than blind trust.

Tips and Practical Guidelines for Using Robo-Advisors

For individuals considering or already using digital wealth platforms, several practical habits can improve outcomes

• Treat the platform as a tool, not a substitute for thinking

• Review assumptions behind suggested portfolios

• Avoid frequent changes driven by short-term news

• Reassess goals periodically rather than constantly

• Maintain a separate emergency fund outside investment accounts

These simple practices align technology with personal discipline.

Data Security and Trust in a Digital Environment

Wealth management platforms handle sensitive information, including income, assets, and personal identifiers. Trust is therefore essential.

Before committing to a platform, users should evaluate

• Regulatory oversight and licensing

• Transparency around data usage

• Security infrastructure and encryption standards

• The platform’s business model and longevity

Digital convenience should be balanced with basic due diligence.

Combining Digital Platforms with Human Advice

Many individuals find value in a blended approach. Digital tools manage routine processes, while human advisors support complex decisions.

Examples of hybrid use include

• Using robo-advisors for automated investing

• Consulting advisors for tax or estate planning

• Leveraging dashboards for ongoing monitoring

This modular approach reflects how financial services are increasingly consumed.

How Digital Wealth Management May Evolve

Looking ahead, fintech and robo-advisory models are likely to evolve further

• Artificial intelligence may enhance personalization

• Behavioral insights may improve investor guidance

• Integration across banking, investing, and payments may deepen

• Regulation may standardize best practices

As these tools mature, they may feel less like alternatives and more like default components of personal finance.

Closing Thoughts: Empowerment Through Simplicity

Digital wealth management has changed the financial landscape by lowering barriers and simplifying complex processes. Fintech platforms and robo-advisors empower individuals to engage with long-term planning in ways that were previously inaccessible.

Yet technology alone does not guarantee good outcomes. The most effective use of digital tools combines automation with awareness, discipline, and realistic expectations. When used thoughtfully, fintech becomes not just a convenience, but a meaningful support system for building and managing wealth over time.